Car Insurance Quotes Atlanta – O’Neal & Associates Insurance

Making the Most of Your Car Insurance Quotes in Atlanta

Atlanta, the bustling metropolis capital of the South, is a city not only famous for its vibrant culture and rich history but also for its bustling streets. With a vast network of highways and city roads, driving in Atlanta comes with its own set of challenges. For residents, obtaining affordable car insurance is not just a necessity but a crucial aspect of responsible vehicle ownership.

O’Neal & Associates Insurance, a trusted name in the industry, understands the unique challenges that Atlanta drivers face and is committed to providing comprehensive coverage tailored to their needs. We delve into many ways the intricacies of car insurance quotes in Atlanta, offering insights and guidance to help residents navigate the urban jungle with confidence and peace of mind.

What You Need to Know About Auto Insurance Quotes in Atlanta

In Atlanta, like in most states and many other cities, car insurance is a legal requirement, mandating drivers to carry minimum coverage to operate their vehicles legally. Before delving into the specifics of car and auto insurance quotes in Atlanta, it’s essential to grasp the foundational aspects of auto insurance.

Car Insurance Requirements in Atlanta: What You Need to Know

Depending on the insurance rates and the policy you choose, your coverage will vary. Here are some of the most popular coverages:

Mandatory Liability Coverage:

In Atlanta, drivers are required by law to carry minimum liability insurance coverage to operate their vehicles legally. The mandatory minimums for liability coverage are defined as follows:

Bodily Injury Liability:

Drivers must have a minimum bodily injury liability coverage of $25,000 per person injured in an accident, up to a total of $50,000 for all eligible persons injured, in addition to $25,000 in property damage liability coverage.

Uninsured Motorist Coverage:

The law also mandates uninsured motorist insurance coverage to protect drivers from financial losses in the event of an accident with an uninsured or underinsured motorist. The minimum coverage required for uninsured motorist bodily injury is $25,000 per person and $50,000 per accident.

Optional Coverage:

While liability insurance covers damages and injuries sustained by other parties in an accident, Atlanta drivers have the option to purchase additional coverage premiums, to insure and protect themselves and their vehicles comprehensively. Optional coverage premium options may include:

Collision Coverage:

This coverage protects your vehicle against damages sustained in a collision with another vehicle or object, and property damage liability regardless of fault.

Comprehensive Coverage:

Comprehensive coverage protects against non-collision-related incidents such as theft, vandalism, fire, or natural disasters.

Medical Payment Coverage:

Medical payment coverage helps cover medical expenses for you and Allstate passengers in the event of an accident, regardless of fault.

Personal Injury Protection (PIP):

PIP coverage provides broader protection for medical expenses, lost wages, and other related costs resulting from an accident, regardless of fault.

There may be additional coverages or discounts that will be necessary based on your unique situation and insurance costs. Be sure to ask our agency how we can tailor your auto coverage to your needs right insurance.

We Cover for High-Risk Drivers: Our Commitment to Atlanta

High-risk drivers’ car insurance rates encompass a diverse range of individuals, including those with previous accidents, traffic violations, DUI convictions, or poor credit history. Despite their classification, these drivers still require adequate car insurance coverage to protect themselves and others on the road. You may be classified as a high-risk driver car insurance policy if you:

Operating a vehicle without a valid license is crucial. A valid license is essential for legally driving your vehicle and maintaining driving privileges.

Driving without insurance is illegal and mandatory by law to shield yourself and others from potential financial risks on the road.

Having a history of multiple traffic violations indicates a higher likelihood of being involved in accidents.

Being responsible for paying for at-fault accidents is a factor that may lead to renters insurance being categorized as high-risk by insurance companies. However, incidents where you are not at fault are less likely to impact your your insurance rate classification.

Various factors, including age and driving experience, can contribute to higher perceived driving risks among other drivers. For example, inexperienced drivers, such as new drivers or younger individuals, may have a higher likelihood of accidents.

Secure Your Atlanta Auto Insurance Quote Today!

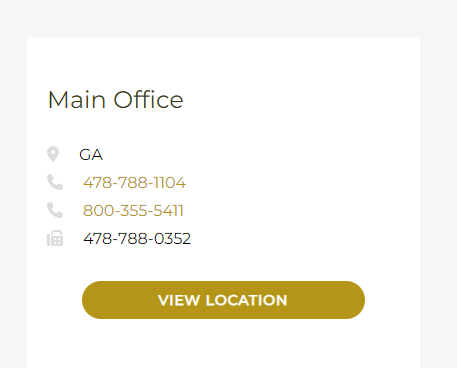

O’Neal & Associates Insurance offers a seamless and convenient process to find the ideal coverage. Discover more about vehicle insurance options and discounts that can protect you and your family. Get Started with a Quote! Call us at 478-788-1104 or Email us by visiting our website to submit your inquiries. You may also visit us at Main Office GA at 478-788-1104 / 800-355-5411 / 478-788-0352. O’Neal & Associates Insurance is committed to helping you find a policy to fit your specific needs.

We are Here for You. Get started with a Quote today with O’Neal & Associates Insurance.

Visit us at our Main Office

Why Choose O’Neal & Associates Insurance for Your Car Insurance Needs?

Personalized Service:

Our experienced agents will work closely with you to understand your unique requirements and find the right insurance coverage and financing options for you.

Variety of Coverage Options:

Whether you’re looking for affordable premiums, basic liability coverage, or comprehensive protection against claims, we have a range of coverage options to suit your needs and budget.

Car Insurance Cost:

We offer competitive rates on auto insurance policies without compromising on the quality of our car and coverage.

Easy Quoting Process:

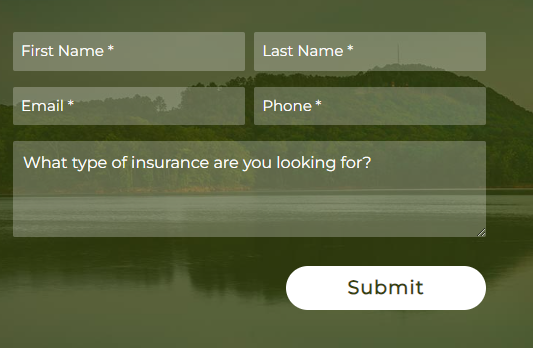

Getting an auto insurance quote with O’Neal & Associates Insurance is quick, affordable, and hassle-free. Simply fill out our online form or give us a call to get started.